Strengths, Weaknesses, Opportunities, Threats (SWOT) Analysis of California’s Low Carbon Fuel Standard

"This Low Carbon Fuel Standard has the ability to increase the use of renewable fuels with the 'first-of-its-kind' regulation. In order to work properly and efficiently, a cost containment strategy would have to be implemented. My internship with REACCH has led me to explore the history and future of renewable and fuel standards and markets, with the hopes of decreasing fossil fuel use."

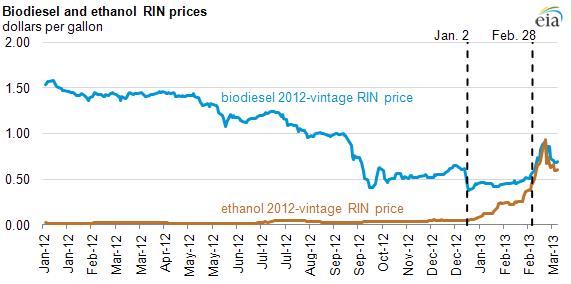

California adopted their Low Carbon Fuel Standard in 2009: ten percent reduction in the carbon intensity of fuels sold in California in the next ten years. Similar to the National Renewable Standard used in the United States, it uses Renewable Identification Numbers or RINs. These RINs are used to track each gallon of renewable fuels that are bought or sold between regulated parties.

Carbon Credits

A unique feature to the Low Carbon Fuel Standard is the credit market.

The compliance credit market is composed of conventional fuel blenders, producers, and importers as well as renewable fuel producers. Conventional fuel parties must buy RINs or RIN credits in order to meet compliance with the Low Carbon Fuel Standard. Renewable fuel producers sell RINs to the conventional fuels parties, which in turn helps the renewable fuel producers gain credits to meet compliance with the standard. The conventional fuel parties mix renewable fuels (which have RIN credits) to the conventional fuels in order to gain credits to meet compliance. If conventional fuel parties do not meet compliance, deficits are created. Deficits call for more credits to be purchased by buying or trading RIN credits from parties, who have already gained enough credits to meet compliance.

Our SWOT analysis of the Low Carbon Fuel Standard addresses some of the issues with being a “first-of-its-kind” regulation.

Strengths and Opportunities

This fuel standard allows for a variety of fuels to meet the standard such as hydrogen, natural gas, and biofuels, which is the largest category of fuel in the standard, giving regulated parties a variety of ways to meet the compliance standard. This Low Carbon Fuel Standard is creating financial incentives for the development and use of low carbon fuels, and incentives to invest in technological advances that aim to reduce the cost of compliance.

For a conventional fuel party that produces more credits than needed to maintain the compliance, they can either sell excess RIN credits or bank the credits for future obligations, which is another strength of the fuel standard. By allowing banking of credits it gives conventional fuel parties the incentive for early production of fuels containing renewable fuels.

Figure 2. Rise in the price of ethanol and biodiesel (Source: eia.org)

Weaknesses and Threats

The weakness with allowing the banking of credits is that it constrains technological innovation. The current RIN market then reflects the future cost increases. This may cause the prices of the credits to increase making it difficult for the conventional fuels parties to afford to buy RIN credits to meet compliance with the standard.

Alternatives

Due to the concern of rising prices in the credit market, the State of California is exploring new cost containment features, which may contain numerous mechanisms to minimize the cost to regulated parties of meeting the compliance. One of these cost containment features is the establishment of a price ceiling and a price floor, to assist in steadying out the price of RINs. Price ceilings and floorings will provide low carbon fuel investors with a more precise projection of what the low price may be in the future, thus reducing the chance that they will lose money on their investment if prices suddenly drop dramatically. This will strengthen the incentives to invest in a low carbon fuel. To achieve a price ceiling a number of mechanisms are being researched such as a credit window, credit clearance, reinvestment plan, non-compliance penalty, and credit multiplier.

For the price floor two mechanisms are being explored. The first mechanism that was developed would apply a deficit multiplier to deficits that were produced below a certain price. This mechanism would lower the supply of the RIN credits available therefore increasing the price back to the appropriate price. The second mechanism that was developed would be for the Air Resource Board to make the standard stricter during the compliance period. All of these mechanisms need further research to ensure their feasibility.

REACCH Undergraduate Summer Interns come from all over the country to spend 9 weeks with REACCH scientists conducting research, gaining job and graduate school training, and sharing their experiences. These blogs are the culmination of their research experience. Christian recently presented his findings at the Pacific Northwest Climate Science Conference in Seattle, WA.

Editor: Leigh Bernacchi

Renewable Identification Numbers

If you’re interested in climate and agriculture, continue reading articles at the blog aggregator, AgClimate.net